- Web Desk

- 10 Hours ago

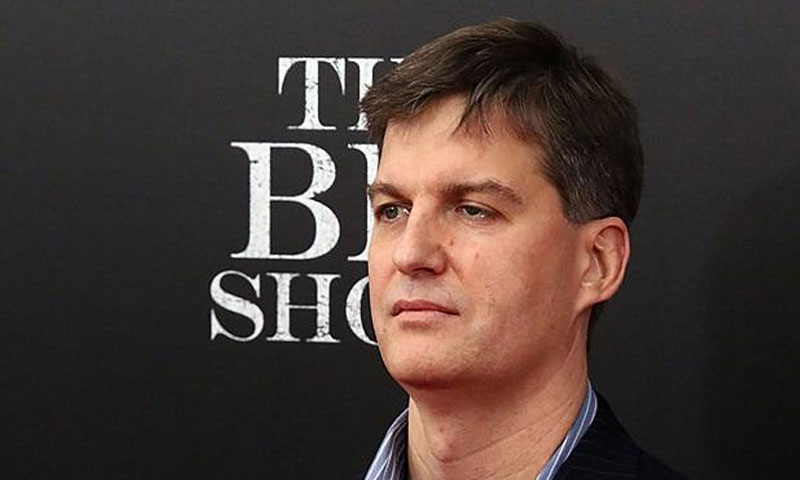

Michael Burry, ‘Big Short’ investor, to close hedge fund

-

- Reuters

- Nov 14, 2025

LONDON/NEW YORK: Michael Burry, the investor famed for his successful bets against the US housing market in 2008, as depicted in the movie “The Big Short”, is closing his hedge fund, Scion Asset Management.

In a letter to investors dated October 27, Burry said he would liquidate the fund and return capital, “but for a small audit/tax holdback,” by the end of the year. A source familiar with the matter confirmed the contents of the letter.

Burry noted in the letter, “My estimation of value in securities is not now, and has not been for some time, in sync with the markets.” He could not be reached immediately for comment.

The U.S. Securities and Exchange Commission (SEC) database shows Scion’s registration status as “terminated” as of November 10. Deregistration means the fund is no longer required to file reports with the regulator or any state. Scion had managed $155 million in assets as of March. Investment funds managing more than $100 million are required to register with the SEC.

Burry has recently intensified his criticism of tech giants, including Nvidia and Palantir Technologies, questioning the cloud infrastructure boom and accusing major providers of using aggressive accounting to inflate profits from their hardware investments.

In a post on X on Wednesday, Burry wrote, “On to much better things Nov 25th.” He added that he had spent about $9.2 million buying roughly 50,000 put options on Palantir, giving him the right to sell the stock at $50 each in 2027. Palantir shares were trading at $178.29 on Thursday, valuing the company at $422.36 billion.

Burry has also raised concerns about other major tech companies. He argued that firms such as Microsoft, Google, Oracle, and Meta are extending depreciation schedules on Nvidia chips and servers to smooth earnings, potentially understating depreciation by about $176 billion between 2026 and 2028 and inflating reported profits across the sector.

Last month, Burry posted an image of his character from *The Big Short* on X, warning of bubbles and stating, “Sometimes the only winning move is not to play.”

Bruno Schneller, managing director at Erlen Capital Management, said, “Burry’s decision feels less like ‘calling it quits’ and more like stepping away from a game he believes is fundamentally rigged.”